Policies

Live tracked policies

Country profiles

About

Country

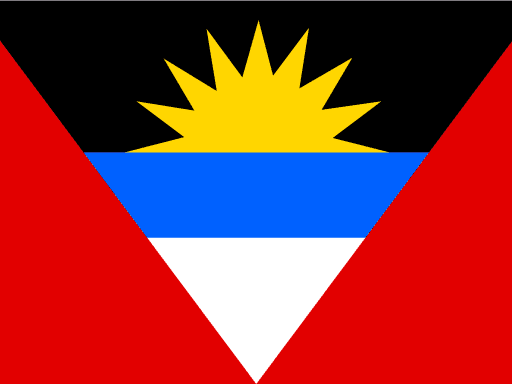

Antigua and Barbuda

Antigua and Barbuda is graded on how well its laws implement each of the policies below. Statements, commitments and votes by Antigua and Barbuda’s government are tracked to determine Antigua and Barbuda’s public position on each of the policies.

Position per policy

Positions indicate where Antigua and Barbuda stands on each policy. Possible positions range from 'Leader' to 'Blocker'.

UN tax convention

No data

Country by country reporting

No data

Global asset register

No data

Unitary tax

No data

Disclosure of data

No data

Enforcement

No data

Good taxes

No data

UN tax convention

Country by country reporting

Automatic exchange of information

Beneficial ownership transparency

Global asset register

Unitary tax

Disclosure of data

Enforcement

Good taxes

About

For the past century, global tax rules have been set by a small club of rich countries at the OECD, some of which rank as the world’s most harmful tax havens. The outcome is tax rules that fail to stop, and sometimes even encourage, tax injustice. Establishing a UN tax convention will give all countries a say on global tax rules through a democratic, inclusive intergovernmental body under the UN, and will introduce global tax rules that must adhere to the UN’s human rights principles.

Position

Loading versions...

Loading assessment data...

Country profiles

Look at another country

Use the country profiles to see all the current

policy data for your country.

About the data

Global experts, crowdsourcing power

The data on the Tax Justice Policy Tracker is regularly collected and verified by researchers and experts at the Tax Justice Network and from the wider global tax justice movement.

Crowdsourcing support from the public helps us respond faster to regulatory changes. If you think an answer to a question on the tracker should be updated with new data, please contact us.